Gross Sales, Cost Of Products Offered And Gross Profit

Therefore, businesses should precisely report COGS to adjust to tax rules and optimize their tax liabilities. Costs can differ considerably over time because of changes in uncooked material prices, labor charges, and different components. This variability can make it difficult to maintain consistent COS calculations and should require frequent changes. In wholesale, COGS displays bulk inventory costs and transport-in—Cost of Sales https://www.kelleysbookkeeping.com/ would extend that to sales rep commissions or order-specific logistics. You should consult your personal professional advisors for advice instantly relating to your small business or earlier than taking motion in relation to any of the content material offered.

The Method To Cut Back Price Of Gross Sales And Improve Gross Profit Margin?

- Some firms may use one term for all direct prices for simplicity.

- As you can see, the income statement for a buying and selling business has a primary section on its own.

- The enter can be measured by the price of sales, the time, or the resources.

- Cost of Gross Sales accents the complete direct price of incomes each euro of revenue.

- It additionally excludes administrative prices or basic overhead prices that aren’t strictly associated to the manufacturing of goods.

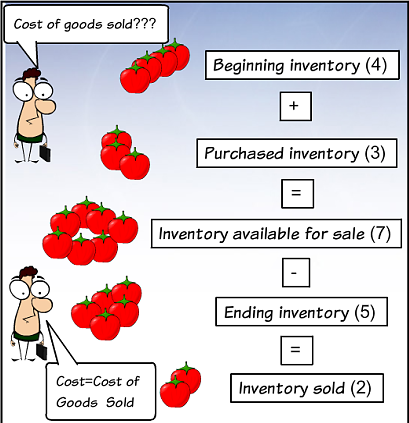

The weighted average method calculates the worth of gross sales by averaging the price of all units out there on the market during a selected interval. It is suitable for companies with homogeneous products and secure prices. Cost of gross sales is normally used for businesses that provide both products and services, or which have a high degree of customization or variability in their choices. They are listed as direct prices and are subtracted from income to calculate the gross revenue.

The Method To Use Cost Of Sales As A Strategic Software For Enterprise Progress And Success?

These prices include labor, uncooked supplies, and overhead instantly tied to manufacturing. The price of sales and value of products sold (COGS) are essential when analyzing whether or not a business is worthwhile. Nonetheless, firms often record COGS or cost of gross sales (and typically both) on their revenue statements, leading to confusion about what they mean. Fortuitously, for these confused, there may be almost no difference between COGS and cost of gross sales in sensible phrases. The value of sales formula assumes that the income and gross profit figures are for a similar period of time, corresponding to a month, a quarter, or a year. If the income and gross profit are for various intervals, then the price of gross sales formulation won’t be correct.

Operating Expenses Vs Cogs

Cost of Gross Sales is an important facet of financial analysis and performs a big function in figuring out an organization’s profitability. It refers back to the direct prices incurred in producing goods or services that are sold to clients. Understanding the concept of value of Gross Sales is crucial for businesses as it helps in evaluating the effectivity of their operations and making informed choices. Value of gross sales helps to improve the operational efficiency of a enterprise. The operational efficiency is the ratio of the output to the enter of a business course of.

Direct supplies are the raw supplies that are used in the manufacturing of products. For instance, in a furniture manufacturing company, wood, nails, and varnish would be thought of direct materials. • Contribution Margin (Revenue – Value of Sales) portrays complete direct profitability, essential for service entities and SaaS companies with negligible stock. The owner of a homeware retailer applies the cost of gross sales formula for a new merchandise – handmade pottery cups – so they can set a aggressive, profitable price. Earnings statements are one of many three most necessary monetary paperwork in your repertoire—and studying how to draw one up is a vital step in understanding your corporation is cost of sales the same as cost of goods sold‘s monetary trajectory. To get extra data on how to build your individual report, take a glance at our web page on the means to prepare an revenue assertion.